Assets

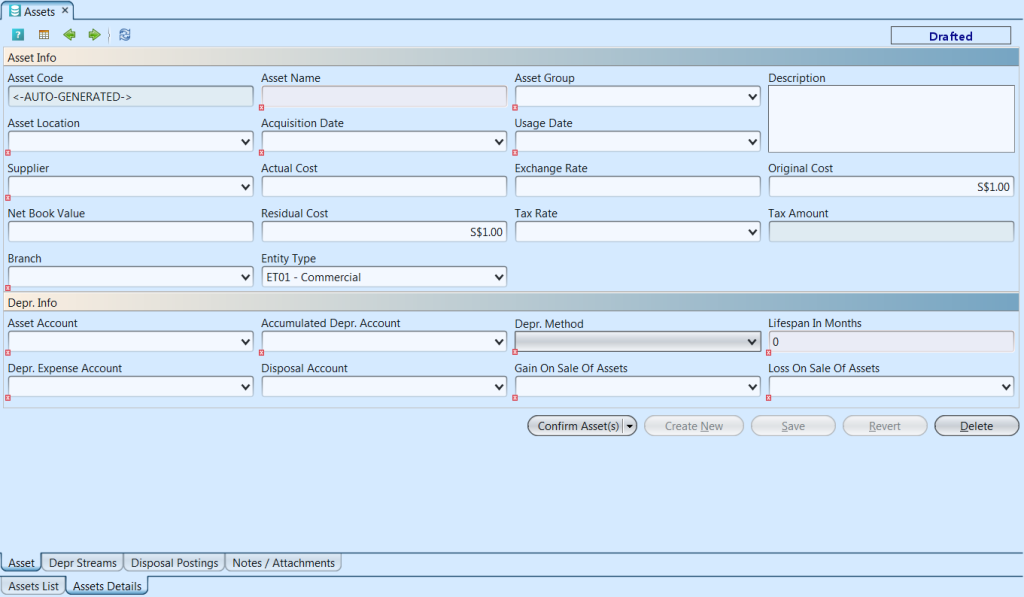

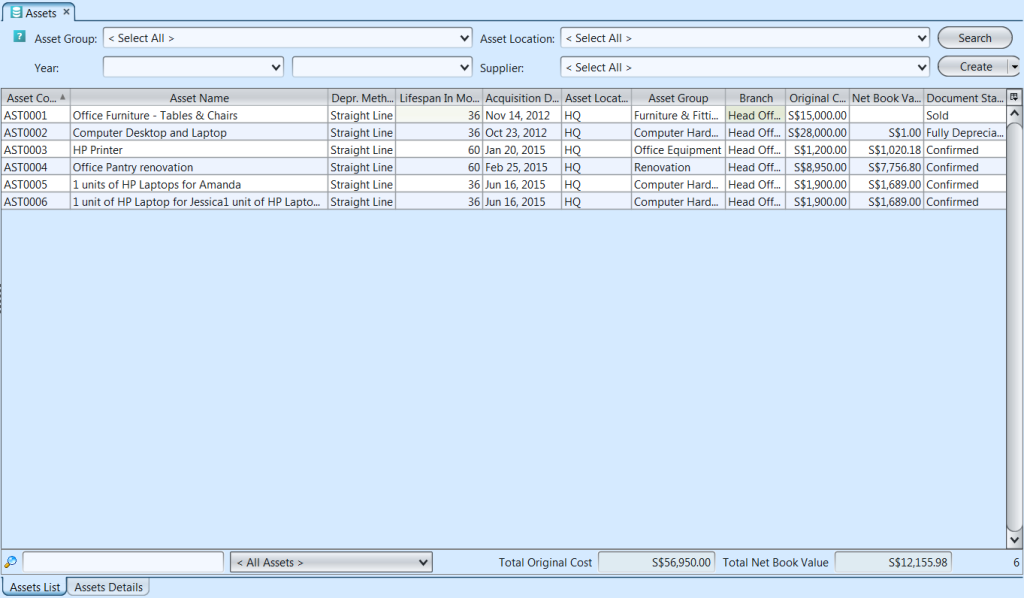

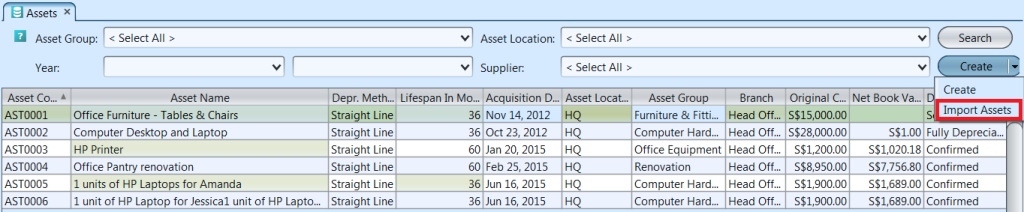

Assets view allows user to record and manage the company’s assets. User can also dispose asset (record) here. Creation of new assets are mainly done when it is purchased (see “Accounts – (Transactions) Non Trade Invoice” for more details), but user can create assets records from this view as well, e.g. for carry-over asset or receive asset from another company.

Below actions are available under “Assets”:

![]() Create new, copy and import existing or carry-over asset;

Create new, copy and import existing or carry-over asset;

![]() Update and move, delete, dispose, sell, view and search for asset

Update and move, delete, dispose, sell, view and search for asset

Field Name |

Description |

Mandatory Information |

| Asset Code | Custom code for the asset |

Y |

| Asset Name | Name of the asset |

Y |

| Asset Group | Select the asset group |

Y |

| Description | Description |

N |

| Asset Location | Select the asset location |

Y |

| Acquisition Date | The date on which a purchase commits to buying an asset and effectively takes control of the asset from the seller. |

Y |

| Usage Date | Date when asset is first used |

Y |

| Supplier | Select the vendor / supplier |

Y |

| Actual Cost | An actual amount paid or incurred, as opposed to estimated cost or standard cost. |

N |

| Exchange Rate |

N |

|

| Original Cost | The total costs associated with the purchase of an asset. The original cost of an asset takes into consideration all of the costs that can be attributed to its purchase and to putting the asset to use. |

N |

| Net Book Value | The value at which a company carries an asset on its balance sheet. It is equal to the cost of the asset minus accumulated depreciation. |

N |

| Residual Cost | Asset’s worth at the end of its lease. |

N |

| Tax Rate | Tax rate associated with this asset |

N |

| Tax Amount | Amount of tax associated with this asset |

N |

| Branch | Select the company’s branch. |

Y |

| Entity Type | Entity type (see Analytical Groups) |

Y |

| Asset Account | Account for the asset |

Y |

| Accumulated Depr. Account | Account for asset’s accumulated depreciation |

Y |

| Depr. Method | Method of depreciation for the asset |

Y |

| Depr. Expense Account | Account for asset’s depreciation expense |

Y |

| Disposal Account | Account for asset’s disposal |

N |

| Gain On Sale of Assets | Account for gain on sale of asset |

Y |

| Loss On Sale of Assets | Account for loss on sale of asset |

Y |

Create New, Copy and Import Existing / Carry-Over Asset

*Note: for newly purchase asset within the current fiscal calendar period, use “Accounts – (Transactions) Non Trade Invoice” to create the asset

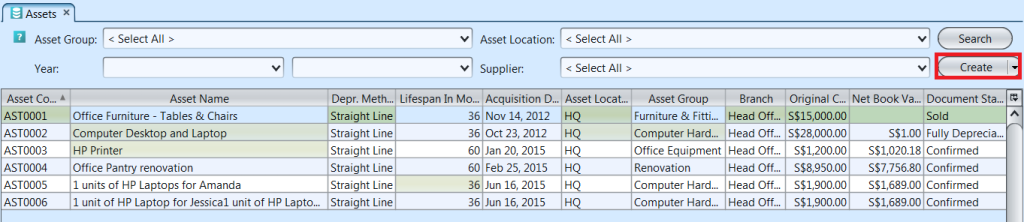

1. Click “Create” button at the top right side of “Assets List” tab, it will open “Assets Details” tab with new form

2. Fill up asset’s information

3. Click “Save” button at the bottom right side of screen when done

4. Click “Confirm Asset(s)” button at the bottom right side of screen and click “Yes” button to confirm

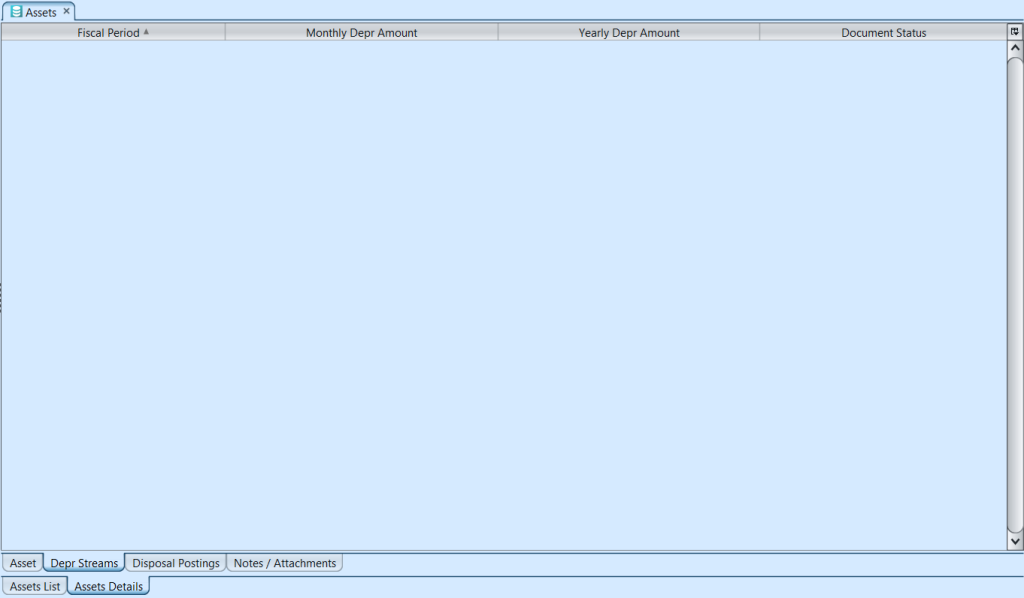

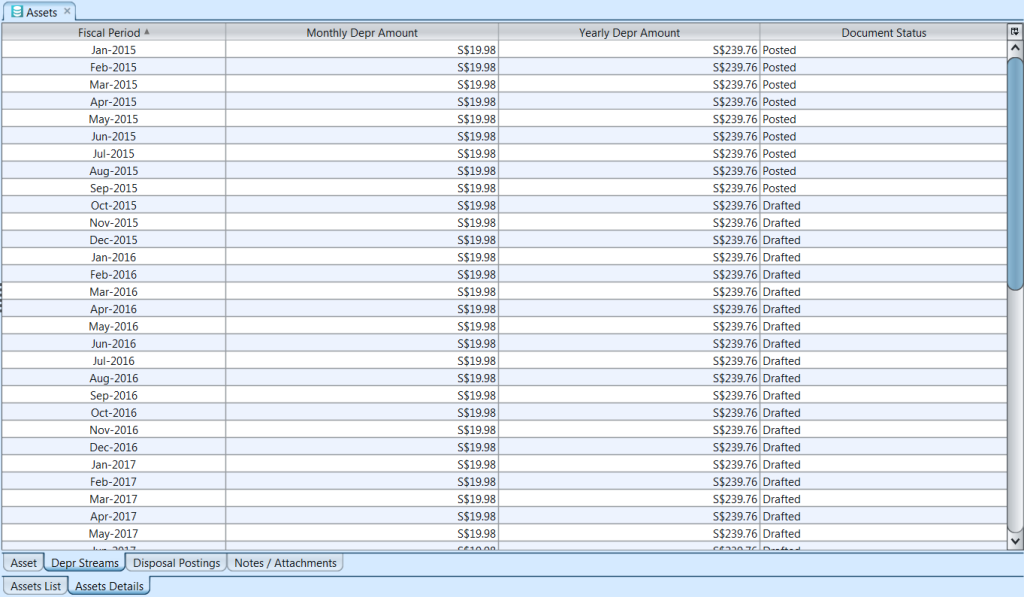

5. Asset depreciation stream entries will be automatically created on “Depr Streams” tab, based on the asset’s “Actual Cost” value divided by “Lifespan In Months” value

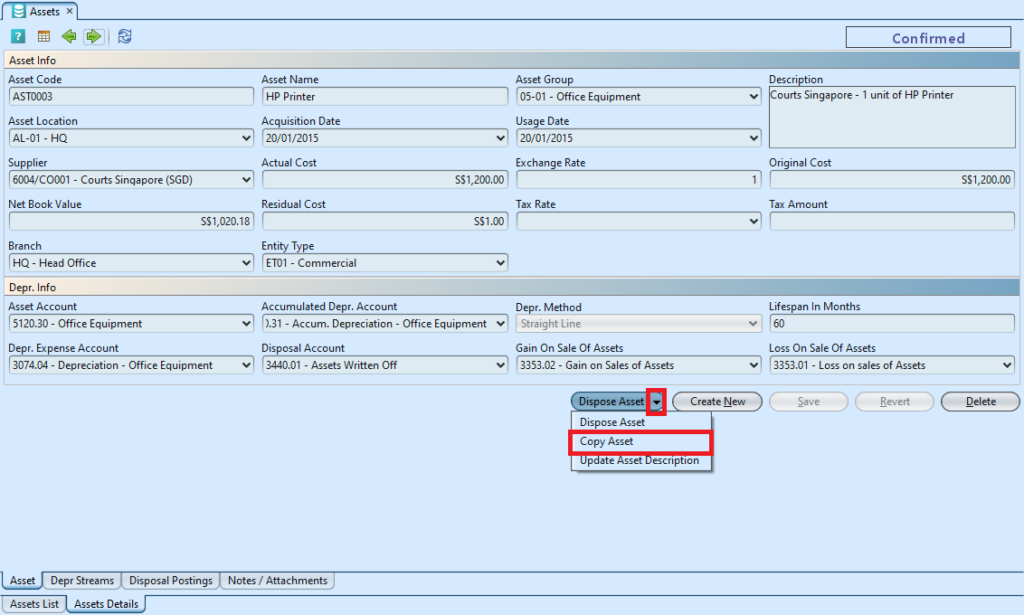

6. To create a (new) copy of the asset record click the arrow on “Dispose Asset” button at the bottom right side of screen and select “Copy Asset”. Then click “Yes” button, it will create a duplicate of the asset record. Make change(s) where applicable

7. On “Assets List” tab click the arrow on “Create” button at the top right side of screen and select “Import Assets”. User can import multiple new asset records to a CSV file

Update and Move Asset

1. Double click on asset to be updated, it will bring up the selected asset details on the “Assets Details” tab.

2. Click “Save” button at the bottom right side of the screen when done with the updates

3. To move the asset’s location, right click on an asset on “Asset List” tab and select “Move Asset(s)”

4. Select the new asset location and branch on the pop-up window, then click “OK” button to complete the move

Delete Asset

- Double click on asset to be deleted, it will bring up the selected asset on the “Assets Details” tab

- Click on “Delete” button at the bottom right side of screen

- Click on “Yes” button on the pop-up window to confirm asset deletion

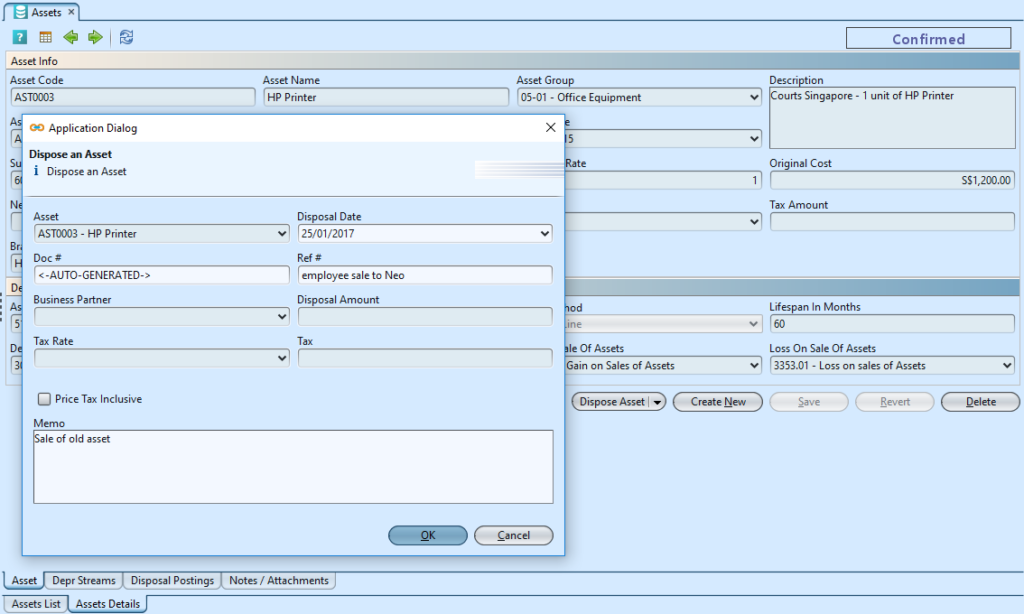

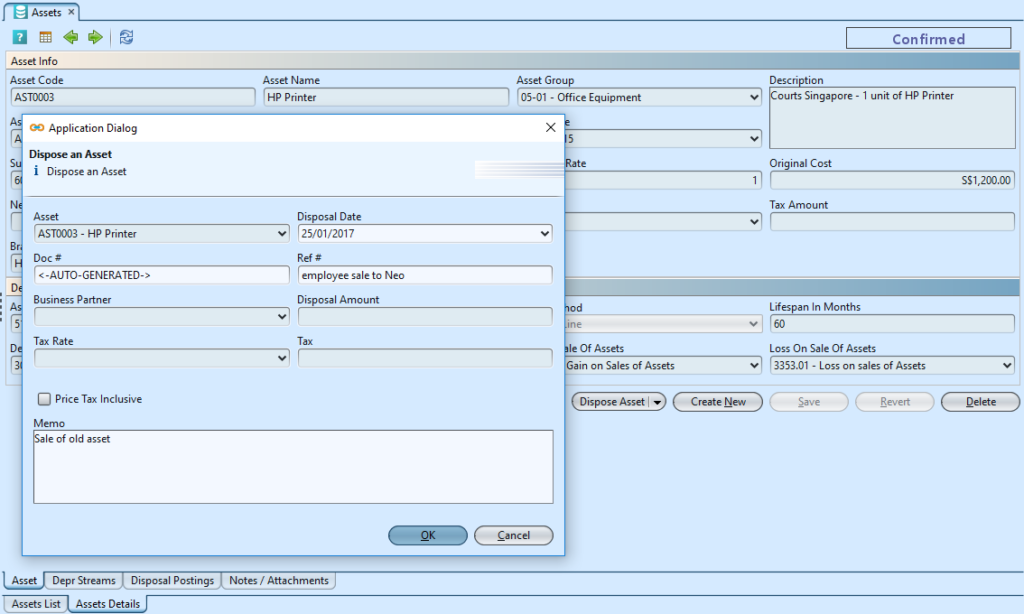

Dispose Asset

- Double click on asset to be dispose, it will bring up the selected asset on the “Assets Details” tab

- Click on “Dispose Asset” button at the bottom right side of screen then click “Yes” button on the pop-up window to confirm asset disposal

- Fill up disposal information on the pop-up window then click “OK” button when done

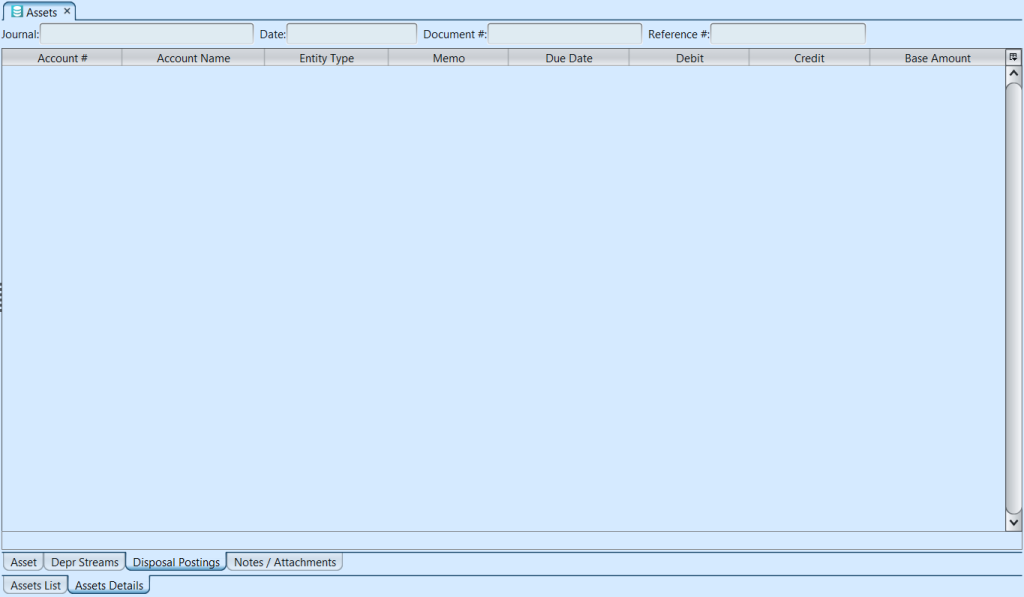

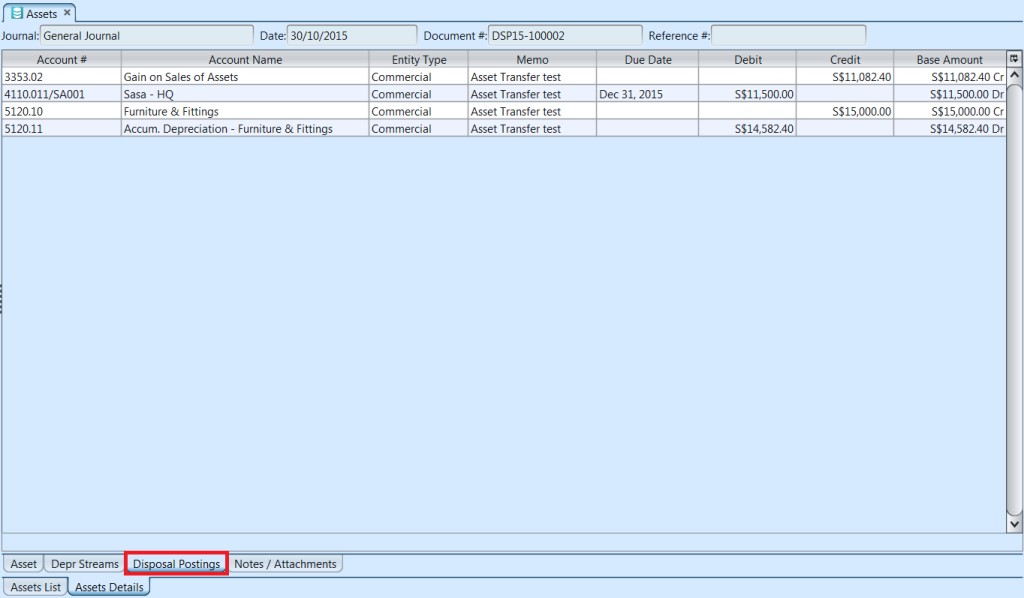

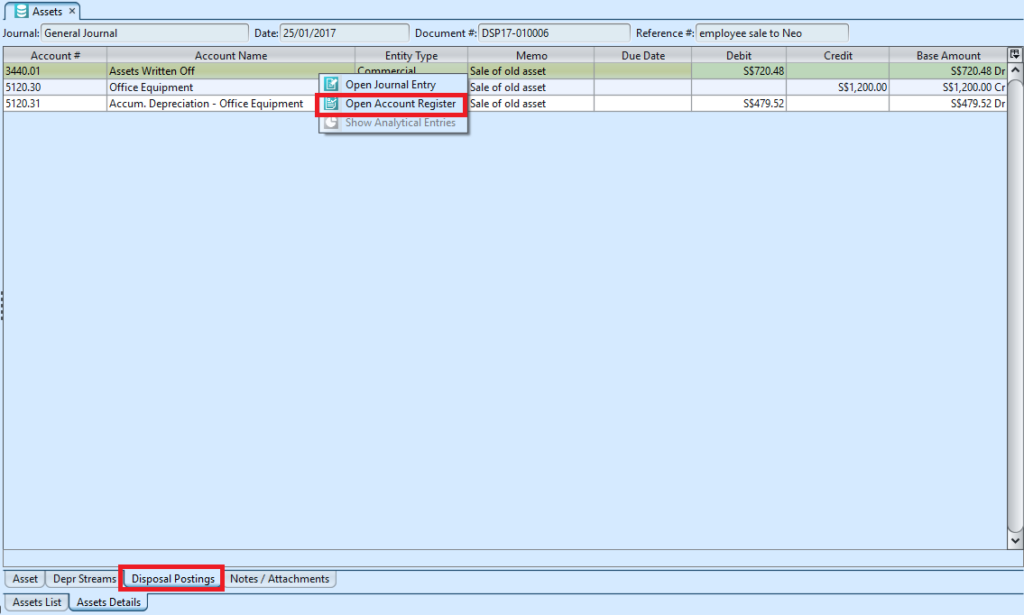

- Asset disposal record posted will be created in the “Disposal Postings” tab under “Assets Details” tab

Sell Asset

- Double click on asset to sell, it will bring up the selected asset on the “Assets Details” tab

- Click on “Dispose Asset” button at the bottom right side of screen then click “Yes” button on the pop-up window to confirm asset disposal

- Fill up disposal information on the pop-up window then click “OK” button when done

- Asset disposal record posted will be created in the “Disposal Postings” tab under “Assets Details” tab

- In the “Disposal Postings” tab, right-click on the journal entry for the disposed / written off asset, and select “Open Account Register”

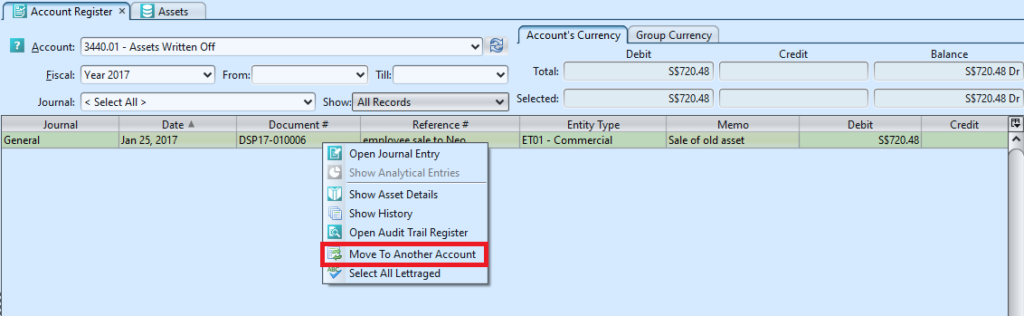

- in the “Account Register”, right-click on the journal entry for the disposed / written off asset, and select “Move to Another Account”

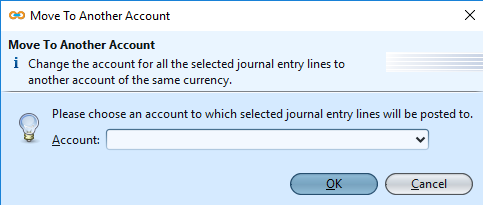

- Select account for sold asset (i.e. “Gain / Loss on Sale of Fixed Assets” account)

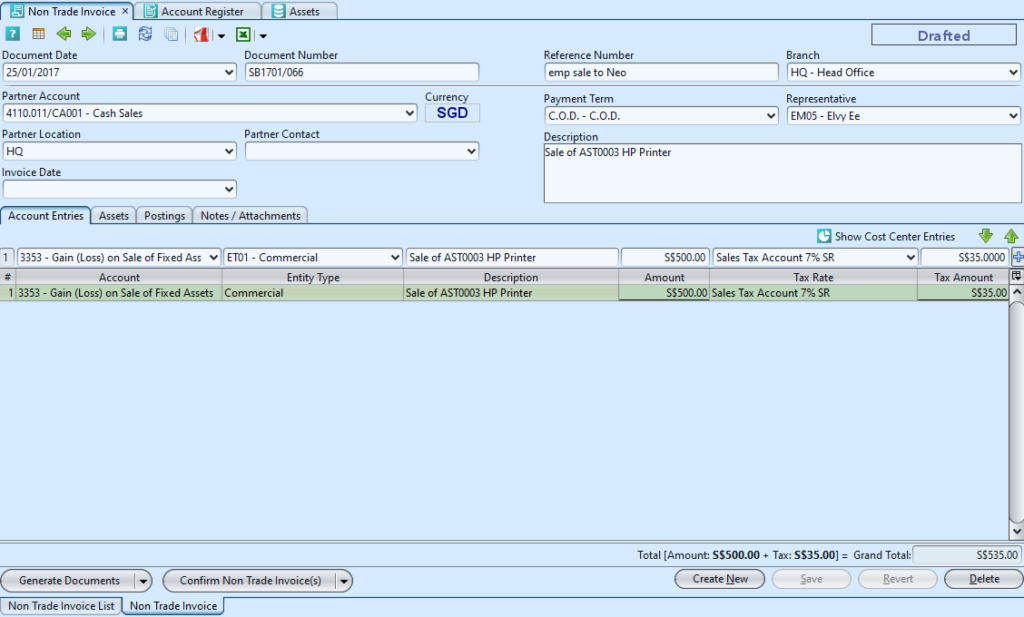

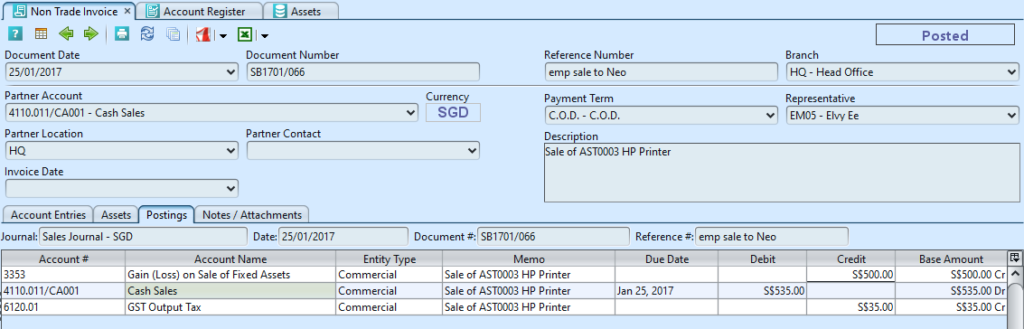

- To create invoice for the sale of the fixed asset, use Non Trade Invoice (Accounts – Transactions).

Open Non Trade Invoice (Accounts – Transactions) and create new document - Enter the header information: i.e. Customer for the “Partner Account”, “Payment Term”, and “Description”

- Enter Account Entries line (i.e. “Gain / Loss on Sale of Fixed Assets” account) for the asset’s sales amount and tax rate (if any)

- Confirm and post the Non Trade Invoice

- Print the Non Trade Invoice

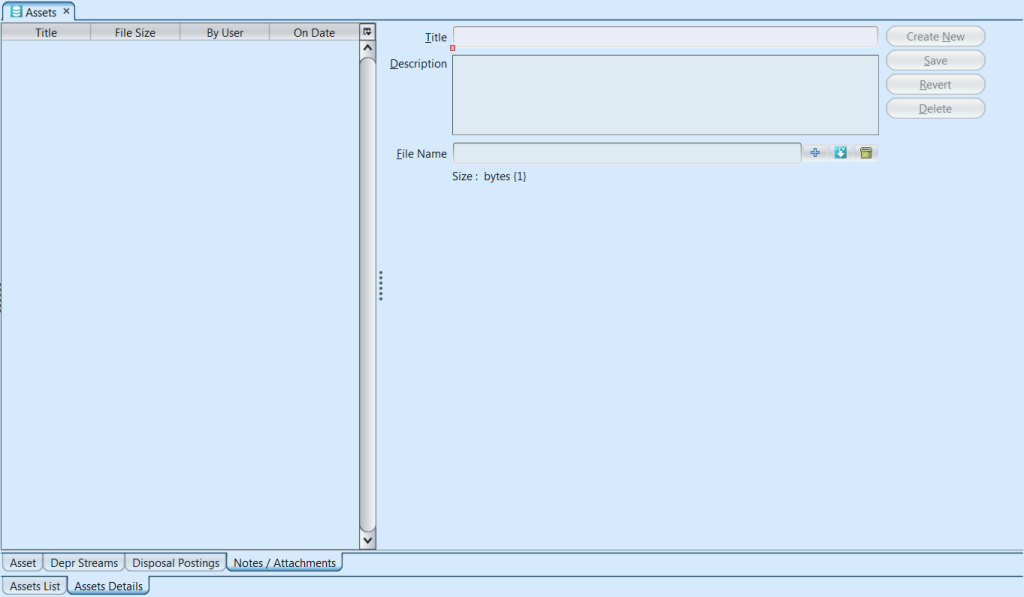

View and search for asset details

- Enter search parameter to filter the result, i.e. type in the asset name in the search textfield box at the bottom left of the assets’ table

- Double click on asset to view, it will bring up the selected asset details on the “Assets Details” tab