Tax Register

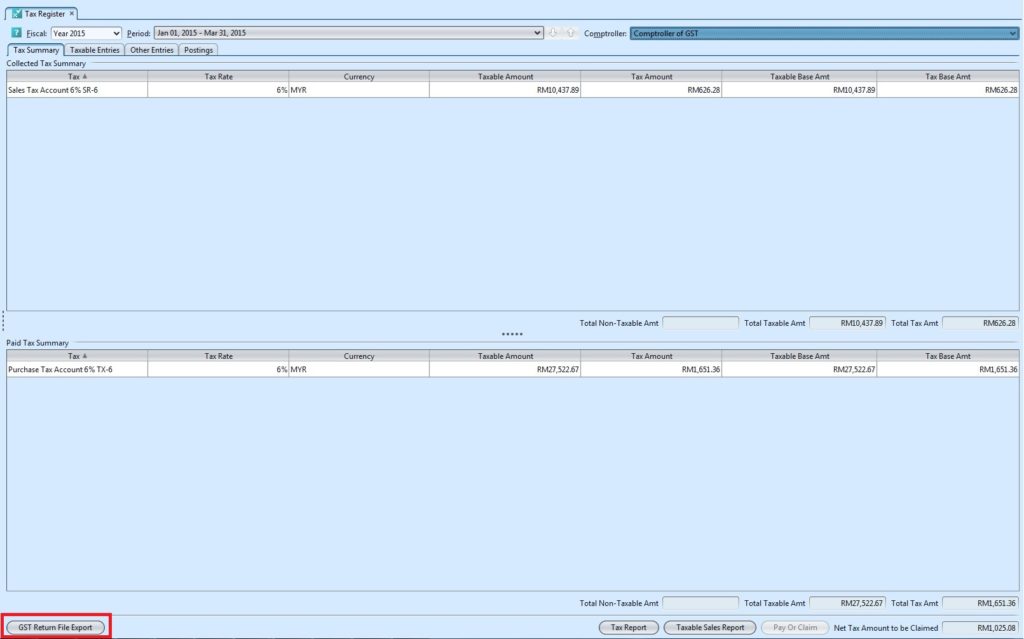

Tax Register allows user to view tax summary and details for applied tax on sales, purchase, and other entries. Below actions are available from “Tax Register”:

![]() Pay or claim tax, print tax summary reports, view and search for taxable entries and other entries

Pay or claim tax, print tax summary reports, view and search for taxable entries and other entries

![]() (Malaysia only) GST Return File Export

(Malaysia only) GST Return File Export

Field Name |

Description |

Mandatory Information |

| Fiscal | Select a fiscal / financial year to view | Y |

| Period | Select a period within the selected fiscal / financial year to view | Y |

| Comptroller | Select a tax comptroller to view | Y |

| Tax | Tax code and name | Y |

| Tax Rate | Self-explanatory | Y |

| Currency | Self-explanatory | Y |

| Taxable Amount | Self-explanatory | Y |

| Tax Amount | Self-explanatory | Y |

| Taxable Base Amt | Self-explanatory | Y |

| Tax Base Amt | Self-explanatory | Y |

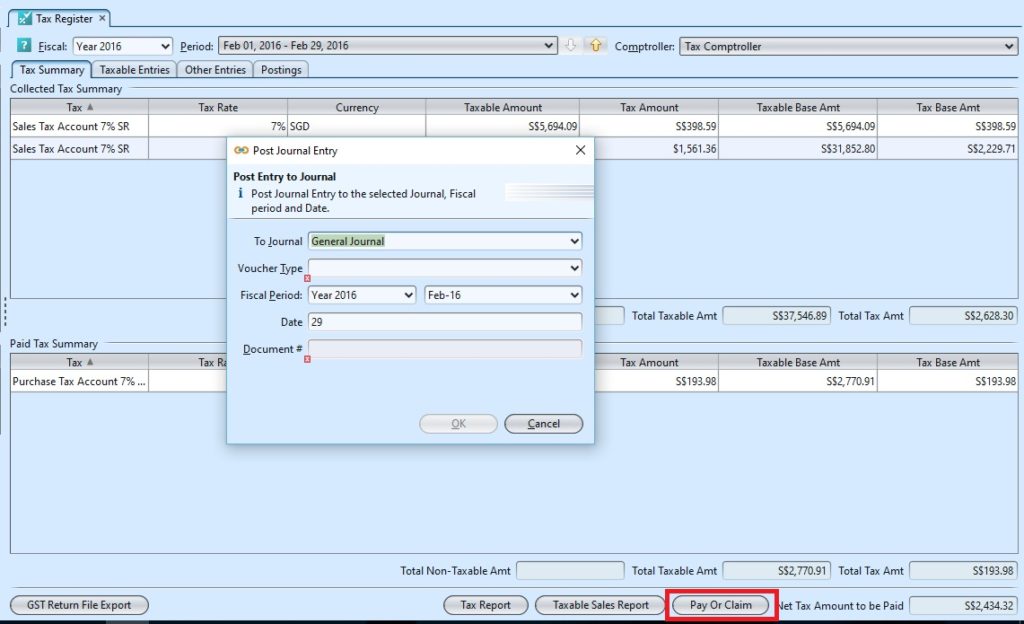

Pay or Claim Tax

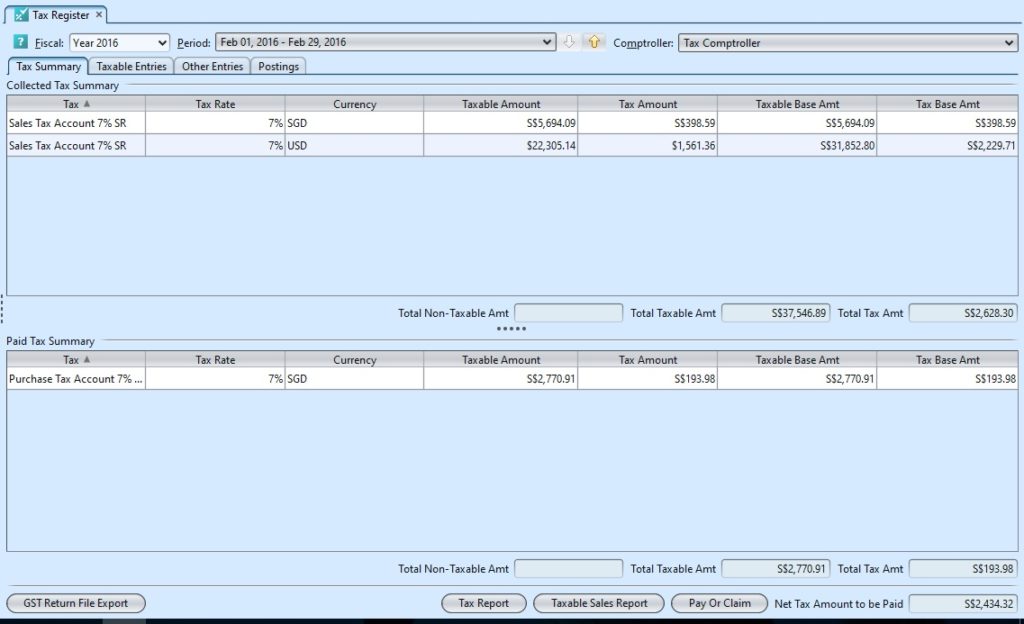

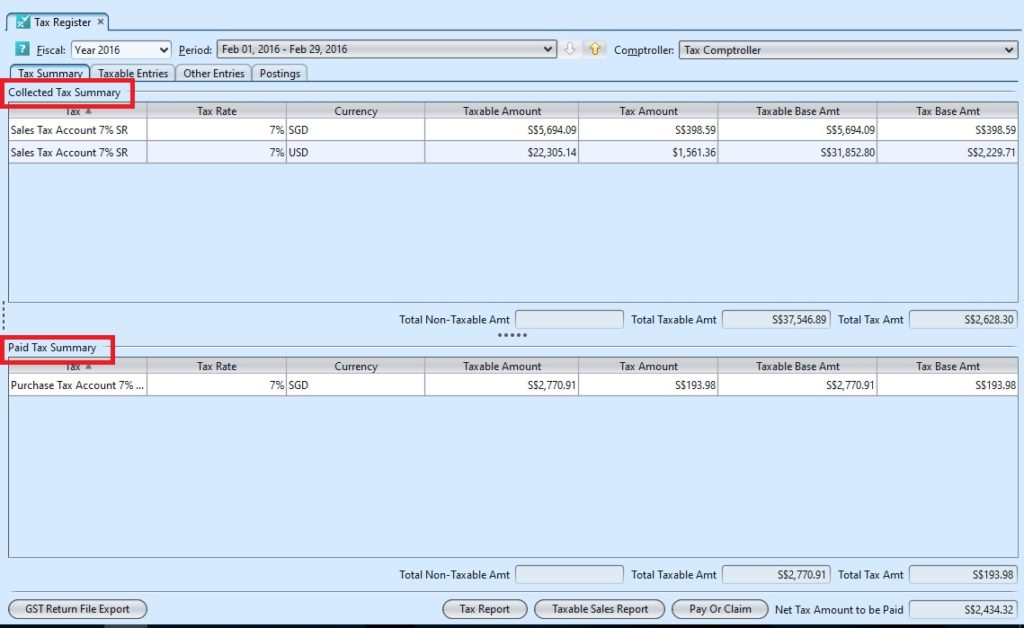

1. On “Tax Summary” tab select an account and fiscal year from the drop-down lists at the top left of the screen, it will pull up account’s journal entries for the selected fiscal year

2. Select a journal entry from either “Collected Tax Summary” or “Paid Tax Summary” table

3. Click “Pay Or Claim” button at the bottom right of the screen to pay or claim the tax, it will pop up a window to “Post Journal Entry” for posting of the tax payment / claim

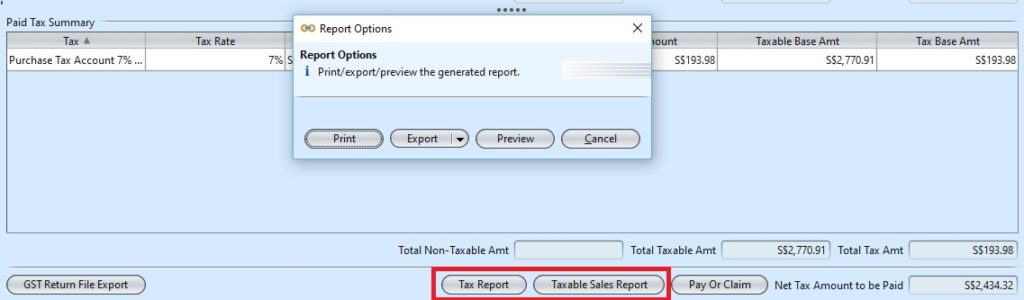

Print Tax Summary Reports

1. On “Tax Summary” tab click “Tax Report” button at the bottom right of the screen to generate tax report for the selected fiscal year and period

2. On “Tax Summary” tab click “Taxable Sales Report” button at the bottom right of the screen to generate taxable sales report for the selected fiscal year and period

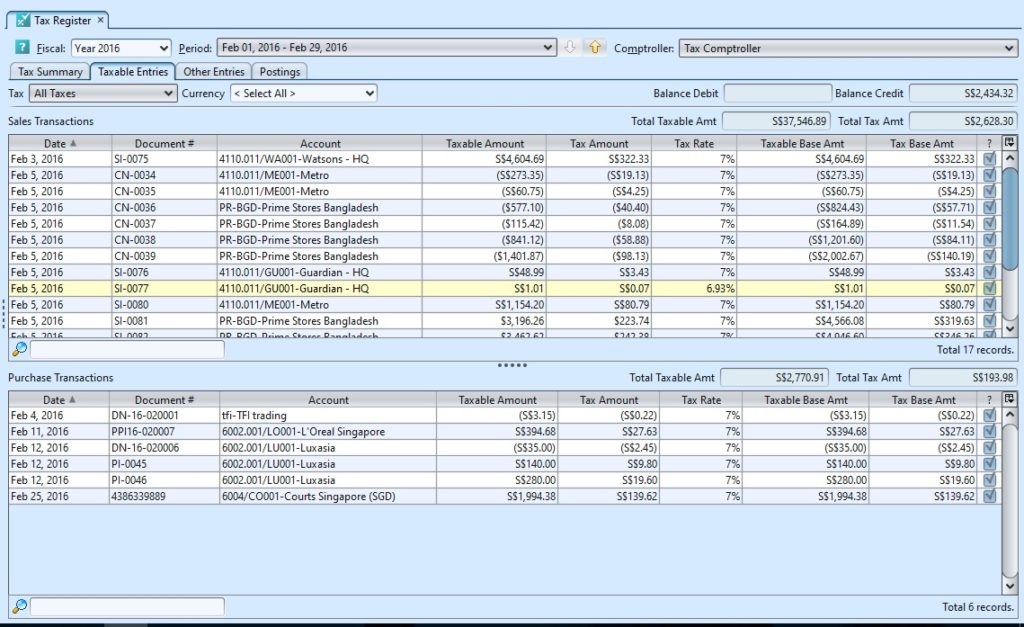

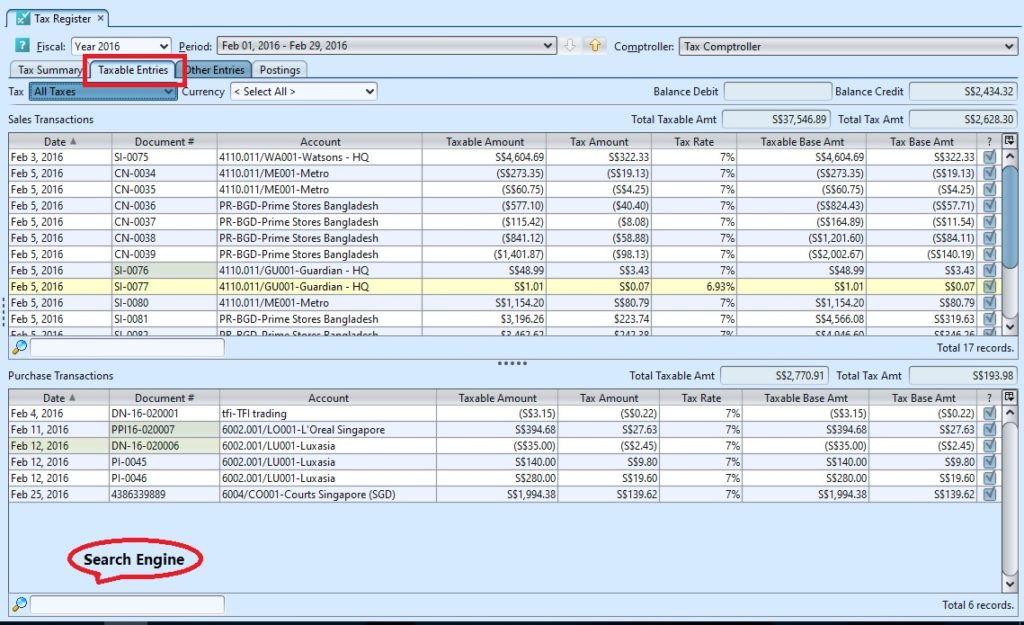

View and Search for Taxable Entries

1. On “Taxable Entries” tab enter search parameter to filter the result, i.e. type in the account name in the search textfield box at the bottom left of the “Sales Transactions” or “Purchase Transactions” table

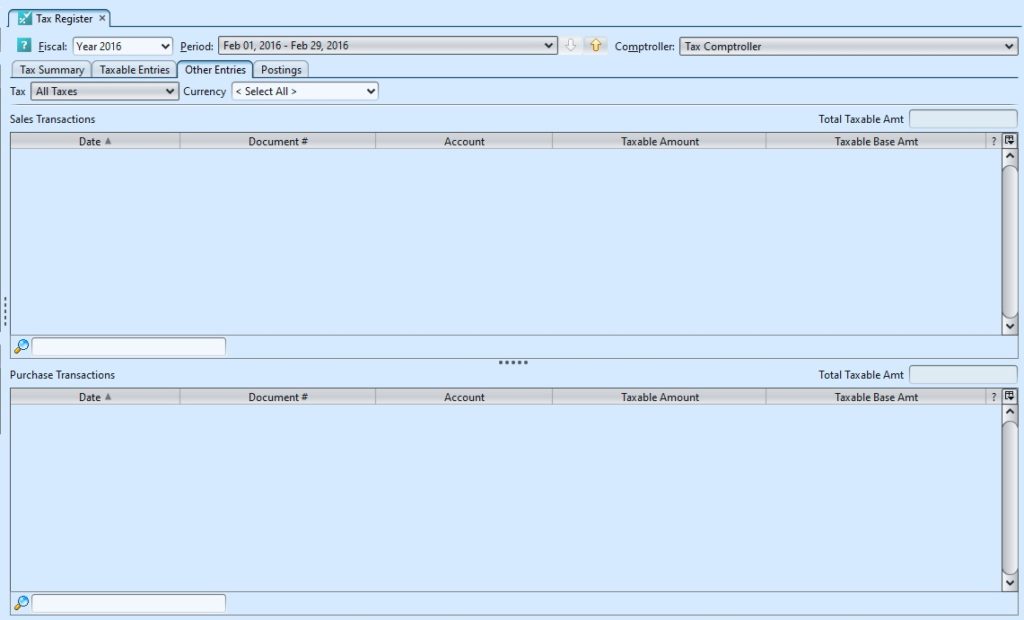

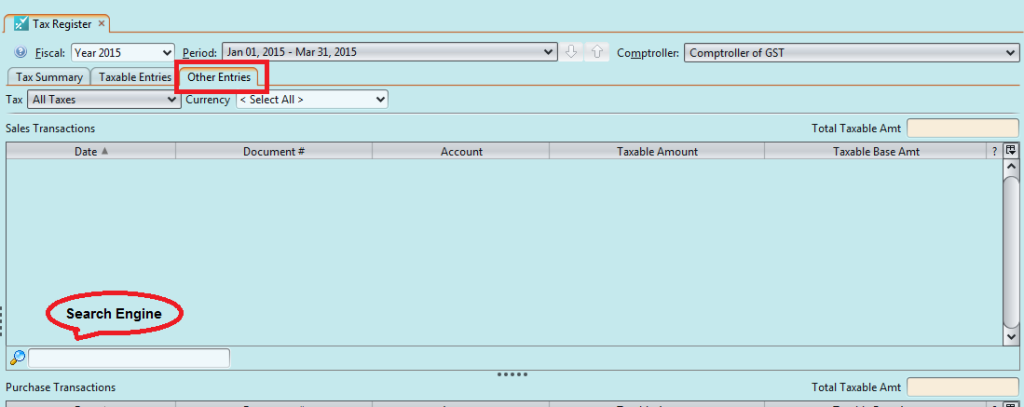

View and Search for Other Entries

1. On “Other Entries” tab enter search parameter to filter the result, i.e. type in the account name in the search textfield box at the bottom left of the “Sales Transactions” or “Purchase Transactions” table

(Malaysia only) GST Return File Export

1. On “Tax Summary” tab, click “GST Return File Export” button at bottom left screen

2. A window dialog will appear, select the folder location and click “Save” button to save the csv file

3. Format of tax return information in the csv file: c1|c2|c3|c4|b5|c6|c7|c8|c9|c10|c11|c12|c13|i14|c15|i16|c17|i18|c19|i20|c21|i22|c23|c24

Note: See the tax return file format in accounting guide document from Royal Malaysian Customs for GST under “APPENDIX 3 – Data Required for GST Filing” page xviii-xix (page 18-19)