Create and manage tax schemes and tax comptroller of a tax scheme. Below actions are available under “Tax Rate”:

![]() Tax Details: Create new tax rate, update, delete

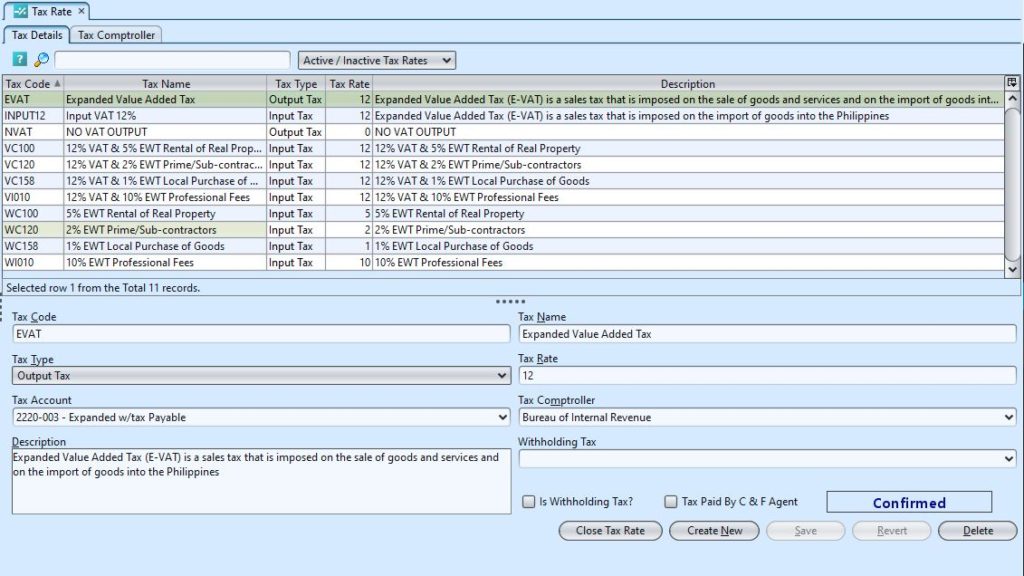

Tax Details: Create new tax rate, update, delete

![]() Tax Comptroller: Create new tax comptroller, set tax payment period, update, delete

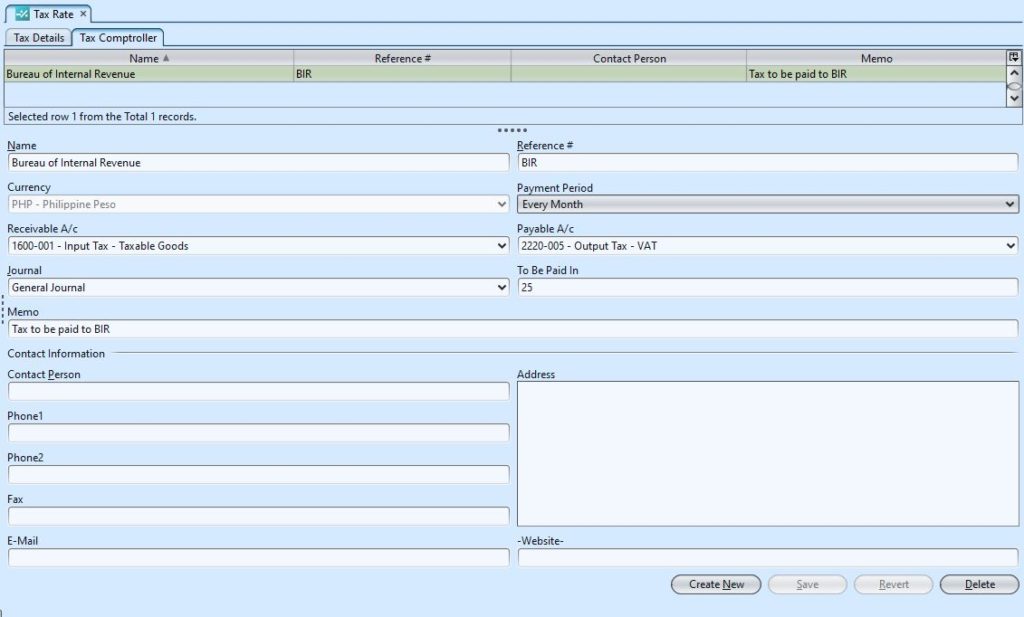

Tax Comptroller: Create new tax comptroller, set tax payment period, update, delete

Tab |

Field Name |

Description |

Mandatory Information |

| Tax Details | Tax Code | Code of the tax | Y |

| Tax Name | Name of the tax | Y | |

| Tax Type | Input or Output Tax type | Y | |

| Tax Rate | The percentage at which an individual or corporation is taxed. | Y | |

| Tax Account | Account for tax | Y | |

| Tax Comptroller | Designated tax comptroller | Y | |

| Withholding Tax | If this is a combination tax with a withholding tax, to select the withholding tax rate from the available list | N | |

| Is Withholding Tax? | Tick if this is a withholding tax | N | |

| Tax Paid By C & F Agent | Select this options for the tax that will be paid by the clearing & forwarding agent (tax paid on import of products from non exempted countries) | Y | |

| Tax Comptroller | Name | Name of tax comptroller | Y |

| Reference # | Reference code for easier search | N | |

| Payment Period | Frequency of tax payment | Y | |

| Receivable A/C | Account for receivable tax (purchase) | Y | |

| Payable A/C | Account for payable tax (sales) | Y | |

| Journal | Type of journal | Y | |

| To be Paid In | Self-explanatory | Y | |

| Memo | Additional note for the tax comptroller | N | |

| Contact Person | Self-explanatory | N | |

| Address | Self-explanatory | N | |

| Phone | Self-explanatory | N | |

| Fax | Self-explanatory | N | |

| Self-explanatory | N | ||

| Website | Self-explanatory | N |

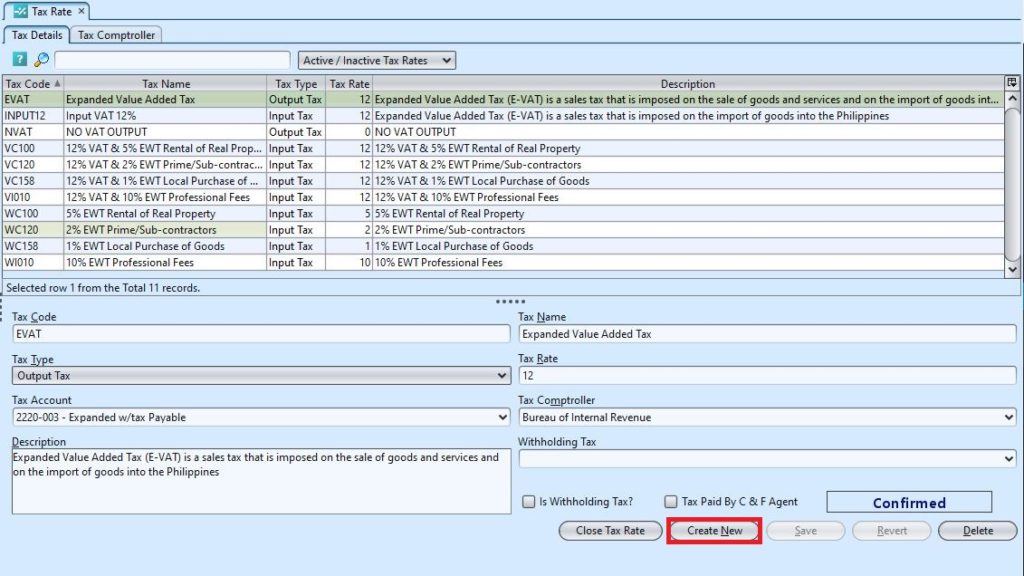

Create New Tax Scheme

1. Click “Create New” button at the bottom right side of screen on “Tax Details” tab, it will create new form for data entry

2. Fill up the tax’s information*.

- Tick “Is Withholding Tax?” checkbox if this tax is a withholding tax type. This tax rate will then be available for selection in the “Withholding Tax” list for tax combination.

- If this tax is a combination tax with withholding tax, select a tax from the “Withholding Tax” list. When this tax rate is used in transaction, the selected withholding tax will be applied as well.

- Tick “Tax Paid By C & F Agent” checkbox if this tax is paid by the carriage & forwarding agent*. This tax cannot be combined with “Withholding Tax” type or combination tax type listed above.

*Note: Ticking the “Tax Paid By C & F Agent” checkbox indicates that this tax is being paid by the Clearing & Forwarding agent, thus the tax for this transaction will not be added on top of the transaction document total value.

3. Click “Save” button at the bottom right side of screen when done

Update Tax Details

1. On “Tax Details” tab double click on tax scheme to be updated, it will bring up the selected tax details on the bottom half of the screen

2. Click “Save” button at the bottom right side of the screen when done with the updates

Delete Tax Scheme

1. On “Tax Details” tab double click on tax scheme to be deleted, it will bring up the selected tax on the bottom half of the screen

2. Click on “Delete” button at the bottom right side of screen

3. Click on “Yes” button on the pop-up window to confirm tax scheme deletion

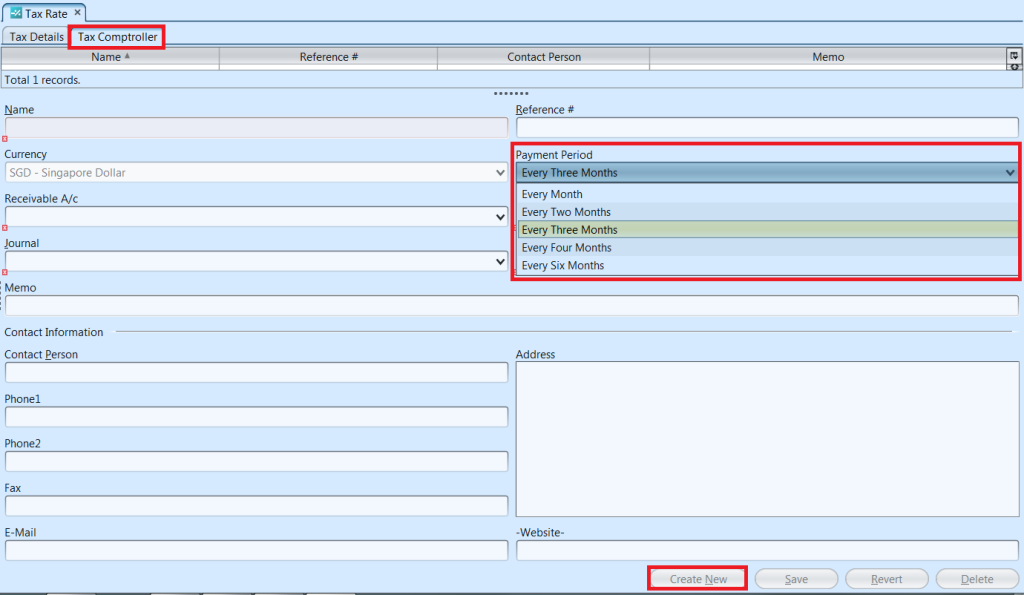

Create New Tax Comptroller, Set Tax Payment Period

1. Click “Create New” button at the bottom right side of screen on “Tax Comptroller” tab

2. Fill up tax comptroller’s information

3. Set the tax payment period from the “Payment Period” drop down list, user can set it by:

- Every Month

- Every Two Months

- Every Three Months

- Every Four Months

- Every Six Months

4. Click “Save” button at the bottom right side of screen when done

Update Tax Comptroller Details

1. On “Tax Comptroller” tab double click on tax comptroller to be updated, it will bring up the selected tax comptroller details on the screen

2. Click “Save” button at the bottom right side of the screen when done with the updates

Delete Tax Comptroller

1. On “Tax Comptroller” tab double click on tax comptroller to be deleted, it will bring up the selected tax comptroller on the screen

2. Click on “Delete” button at the bottom right side of screen.

3. Click on “Yes” button on the pop-up window to confirm tax comptroller deletion.